How to Make Strategies¶

Python, known for its straightforward syntax and widespread popularity, is used for creating customized strategies.

Note

Some variable types in this guide come from specific libraries, including both standard and external ones.

solie:AccountState,Decision,Position,PositionDirection,OrderType,OpenOrderpandas:Series,DataFramedatetime:datetime

Basic Knowledge¶

“Symbol” refers to a market symbol that binds trading targets. A representative example is BTCUSDT.

Creating Your Own Strategy¶

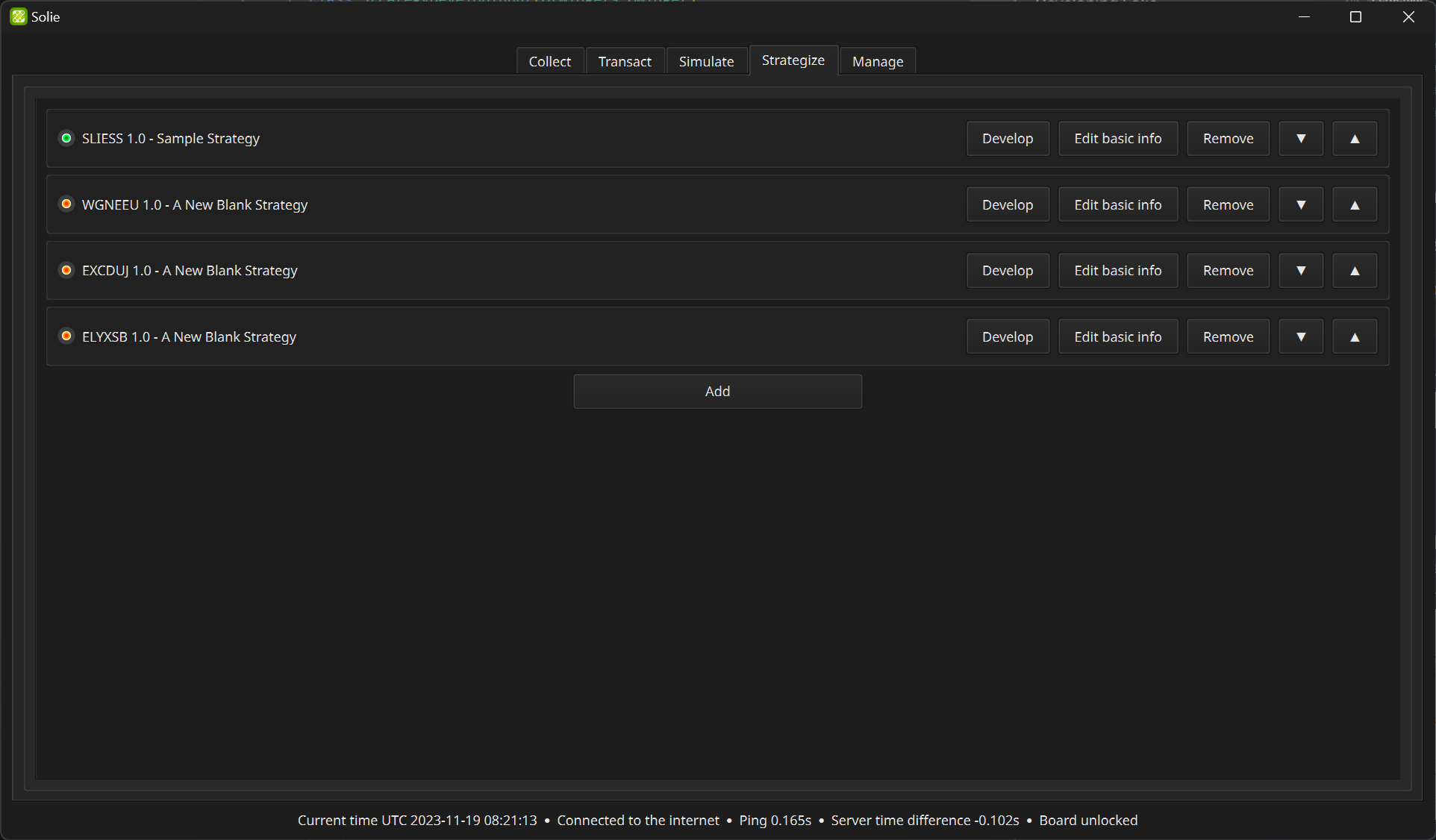

You can create your own strategy in the “Strategize” tab. Set strategy properties by clicking “Edit basic info” button.

Script Editor¶

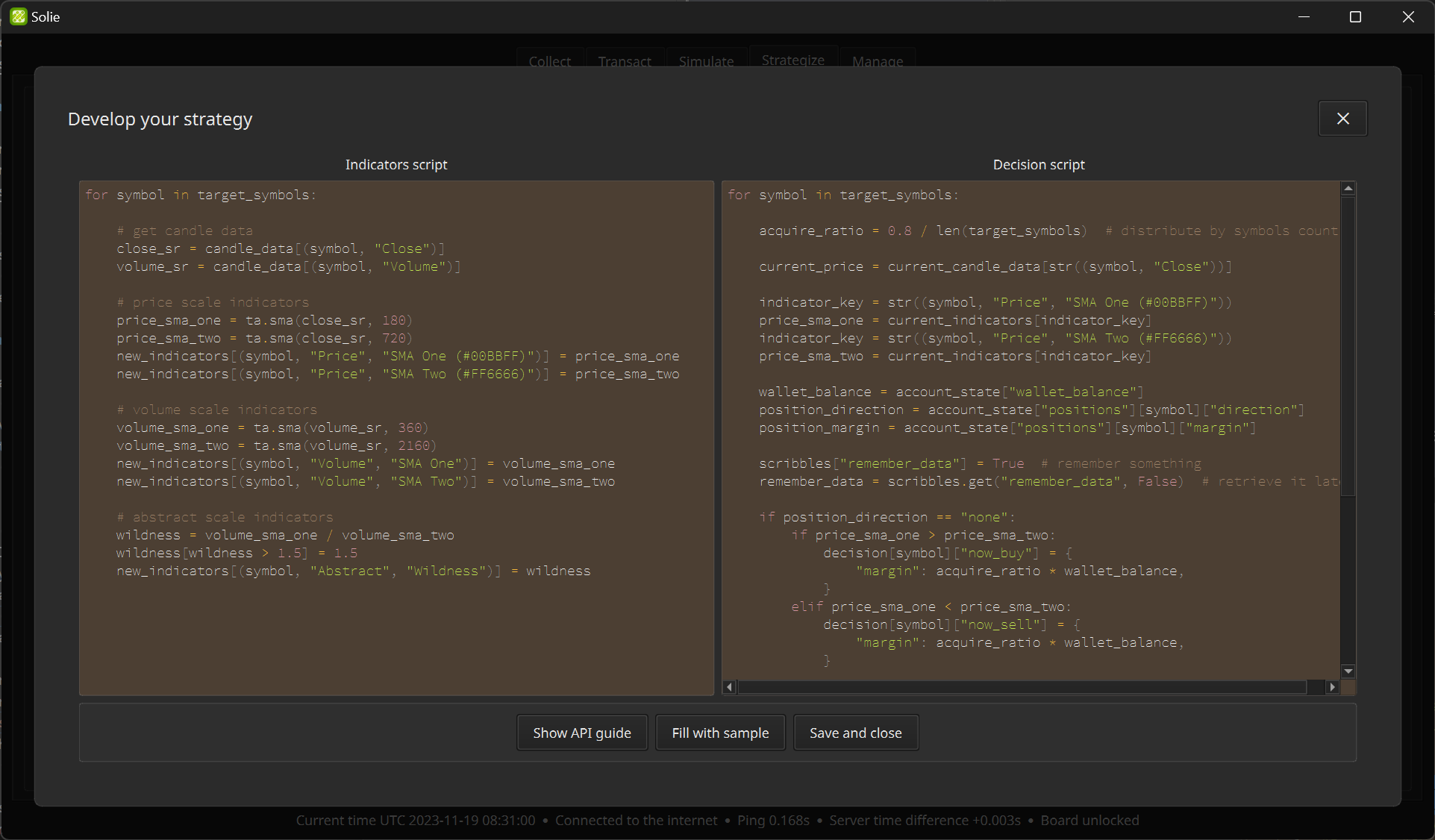

If writing a script from scratch is burdensome, it`s a good idea to start with a sample script.

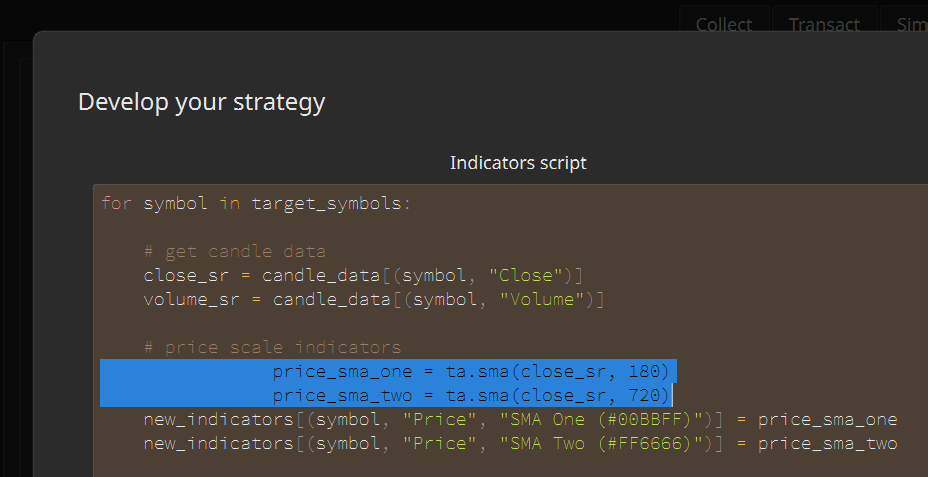

You can indent or outdent multiple lines at once while writing a script. Select all the lines you want and press Tab or Shift+Tab.

If the script contains some broken code, a function that is executed periodically, such as graph update, repeatedly generates an error. In this case, the graph may not be updated or the simulation calculation may stop quickly. In that case, find out the cause in the “Logs” inside the “Manage” tab.

Strategy’s Basic Info¶

If parallel calculation is used, the entire period is cut by a certain length during simulation calculation, calculated separately, and then combined. This has the advantage of speeding up simulation calculations, but also has the disadvantage that it does not result in continuous asset calculations. For example, if you divide by 7 days, the asset and position status will return to the origin every 7 days.

In the internal calculation, the asset status is returned to the origin for each split length, but the final graph and result display show the corrected values as if they were calculated continuously as if they were all added together. Since this calibration process refers to the input value of “Chunk division”, changing the “Chunk division” in the state that there is already calculated data may cause the graph and result display to be very strange.

It is recommended to set the “Chunk division” of parallel computation appropriately. Splitting by more than the number of child processes visible in the “Status” of the “Manage” tab does not contribute to the speedup. Be careful not to make the chunk division too short so that the asset’s state doesn’t change to origin too often.

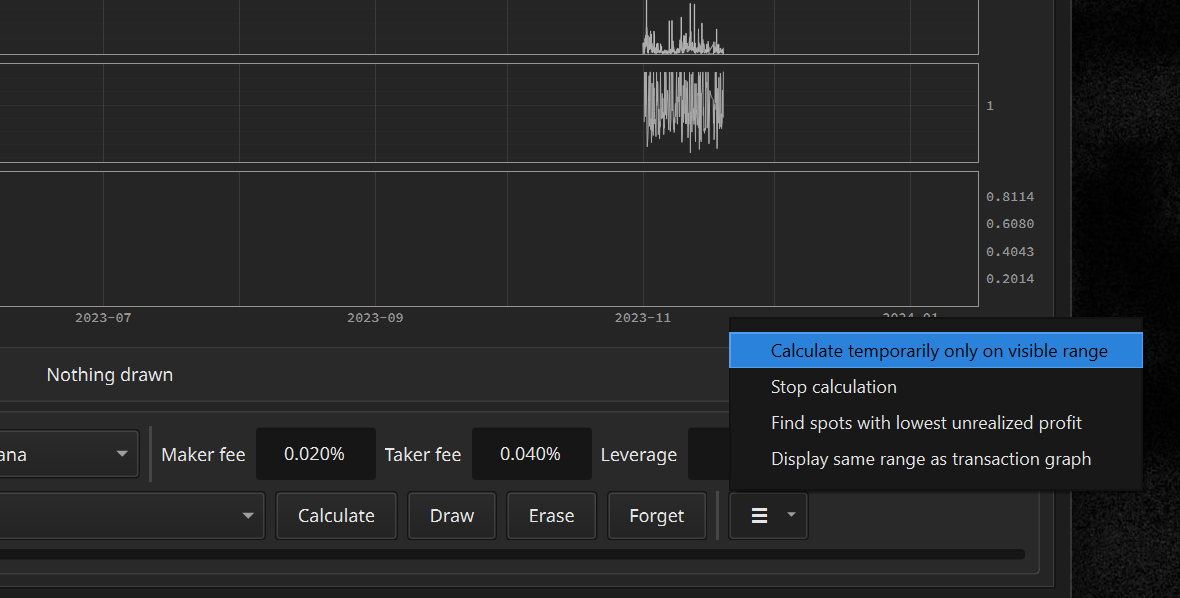

Basic simulation calculations cover the entire year, which is a slow operation that takes minutes to tens of minutes. If you want to experiment with that strategy a little faster, try performing a temporary calculation on the visible range.

Writing the Indicator Script¶

Indicator script is used to create indicators used for graph display and decision.

API¶

Variables provided by default are as follows. You can use these without any import statements.

target_symbols(list[str]): The symbols being observed.candle_data(DataFrame): Candle data. Extra 28 days of data before desired calculation range is included.new_indicators(dict[str, Series]): An object that holds newly created indicators.

Basic Syntax¶

Candle data exists internally in the form of a tabular DataFrame.

MATICUSDT LTCUSDT

CLOSE HIGH LOW OPEN VOLUME CLOSE HIGH LOW OPEN VOLUME

2022-02-24 15:28:30+00:00 1.339 1.339 1.338 1.339 31966.0 96.98 96.99 96.85 96.93 669.532

2022-02-24 15:28:40+00:00 1.338 1.339 1.337 1.339 47233.0 96.89 97.00 96.85 96.99 395.509

2022-02-24 15:28:50+00:00 1.339 1.340 1.338 1.338 49107.0 96.97 96.99 96.88 96.89 803.709

2022-02-24 15:29:00+00:00 1.338 1.340 1.337 1.339 62917.0 96.85 97.00 96.85 96.96 541.428

2022-02-24 15:29:10+00:00 1.335 1.338 1.334 1.338 99874.0 96.71 96.88 96.71 96.86 797.188

2022-02-24 15:29:20+00:00 1.337 1.337 1.335 1.335 74435.0 96.83 96.85 96.71 96.71 174.285

2022-02-24 15:29:30+00:00 1.337 1.338 1.336 1.337 121574.0 96.81 96.86 96.81 96.84 110.111

2022-02-24 15:29:40+00:00 1.337 1.338 1.336 1.337 37174.0 96.88 96.91 96.80 96.81 795.653

2022-02-24 15:29:50+00:00 1.336 1.339 1.335 1.338 204744.0 96.75 96.94 96.71 96.87 1580.639

2022-02-24 15:30:00+00:00 1.334 1.336 1.334 1.336 104203.0 96.64 96.74 96.64 96.74 536.685

... ... ... ... ... ... ... ... ... ... ...

2022-02-26 01:27:40+00:00 1.571 1.572 1.571 1.572 3565.0 112.72 112.77 112.72 112.77 10.731

2022-02-26 01:27:50+00:00 1.572 1.572 1.571 1.571 45791.0 112.72 112.77 112.72 112.73 628.011

2022-02-26 01:28:00+00:00 1.572 1.572 1.572 1.572 1842.0 112.74 112.75 112.72 112.72 153.902

2022-02-26 01:28:10+00:00 1.572 1.572 1.572 1.572 2983.0 112.72 112.74 112.71 112.74 50.900

2022-02-26 01:28:20+00:00 1.572 1.572 1.571 1.572 2424.0 112.71 112.71 112.70 112.71 31.024

2022-02-26 01:28:30+00:00 1.573 1.573 1.572 1.572 4587.0 112.75 112.77 112.70 112.70 140.505

2022-02-26 01:28:40+00:00 1.574 1.574 1.573 1.573 36205.0 112.76 112.77 112.74 112.76 37.946

2022-02-26 01:28:50+00:00 1.574 1.574 1.574 1.574 2143.0 112.76 112.76 112.76 112.76 0.000

2022-02-26 01:29:00+00:00 1.574 1.574 1.574 1.574 6228.0 112.77 112.77 112.76 112.77 96.222

2022-02-26 01:29:10+00:00 1.572 1.573 1.572 1.573 3848.0 112.73 112.76 112.72 112.76 67.306

You can extract partial Series from candle_data which is a DataFrame.

import pandas as pd

for symbol in target_symbols:

open_sr: pd.Series = candle_data[f"{symbol}/OPEN"]

high_sr: pd.Series = candle_data[f"{symbol}/HIGH"]

low_sr: pd.Series = candle_data[f"{symbol}/LOW"]

close_sr: pd.Series = candle_data[f"{symbol}/CLOSE"]

volume_sr: pd.Series = candle_data[f"{symbol}/VOLUME"]

The Series object has the following form. A one-dimensional array containing values over time.

2020-01-01 00:00:00+00:00 129.11

2020-01-01 00:00:10+00:00 129.03

2020-01-01 00:00:20+00:00 129.03

2020-01-01 00:00:30+00:00 128.94

2020-01-01 00:00:40+00:00 128.91

2020-01-01 00:00:50+00:00 128.97

2020-01-01 00:00:00+00:00 128.98

2020-01-01 00:01:10+00:00 129.03

2020-01-01 00:01:20+00:00 129.04

2020-01-01 00:01:30+00:00 129.01

...

2022-02-20 10:41:20+00:00 2633.99

2022-02-20 10:41:30+00:00 2633.07

2022-02-20 10:41:40+00:00 2633.43

2022-02-20 10:41:50+00:00 2633.04

2022-02-20 10:42:00+00:00 2633.24

2022-02-20 10:42:10+00:00 2632.45

2022-02-20 10:42:20+00:00 2630.84

2022-02-20 10:42:30+00:00 2631.55

2022-02-20 10:42:40+00:00 2630.69

Solie uses the pandas-ta package. Creation of dozens of basic indicators is available with this, including moving average, bollinger band, double exponential moving average, triple exponential moving average, stochastic, and parabolic. For more information, check the official documentation of pandas-ta🔗.

import pandas_ta as ta

for symbol in target_symbols:

close_sr = candle_data[f"{symbol}/CLOSE"]

sma_sr: pd.Series = ta.sma(close_sr, 60)

# 60 candles represent 600 seconds(10 minutes)

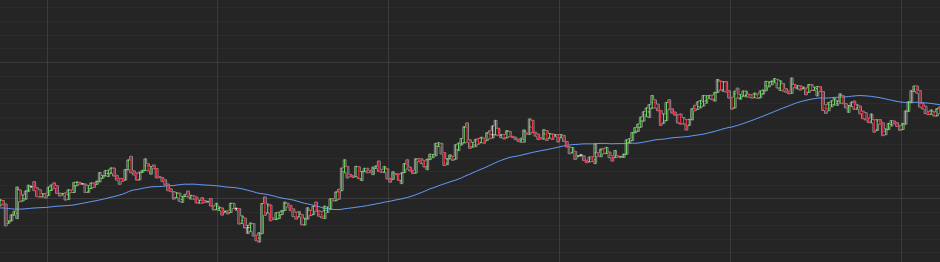

Once you have created the indicators, simply put them in a dict[str, Series] object called new_indicators. After that, multiple Series objects inside this object are merged into a single indicators object. After writing this and saving it, you will see the indicator in the graph view. It can also be used in strategic decisions.

import pandas_ta as ta

for symbol in target_symbols:

close_sr = candle_data[f"{symbol}/CLOSE"]

sma_sr = ta.sma(close_sr, 60)

new_indicators[f"{symbol}/PRICE/SMA"] = sma_sr

The string key consists of 3 values. The first value represents a symbol and the third value would be any name you want. The second value determines which scale graph to draw on. It should be one of PRICE, VOLUME, or ABSTRACT.

Graph 1:

PRICEindicatorsGraph 2:

VOLUMEindcatorsGraph 3:

ABSTRACTindicatorsGraph 4: Only asset information

Taking the

BTCUSDTsymbol as an example, prices move in tens of thousands of dollars, volume moves in tens, and abstract indicators move in single digit units. Of course, you can’t show these three different scales in one graph. That’s why we let you choose the graph to be drawn with the second value of the string key.

You can set the color drawn on the graph as you wish. Just put parentheses next to the name and color code it. Color codes can be chosen on a color combination site🔗.

import pandas_ta as ta

for symbol in target_symbols:

close_sr = candle_data[f"{symbol}/CLOSE"]

sma_sr = ta.sma(close_sr, 60)

new_indicators[f"{symbol}/PRICE/SMA(#649CFF)"] = sma_sr # Blue

Up to this point, indicators generation has been completed using the

Up to this point, indicators generation has been completed using the Series object and the pandas-ta module. However, the flexibility of the way metrics are generated by means of coding comes from now on. The Series object can be manipulated in a variety of ways, including addition, subtraction, division, and conditional transformations. The pandas official documentation🔗 has a more detailed explanation.

Below is the code that creates the average of two different moving averages.

import pandas_ta as ta

for symbol in target_symbols:

close_sr = candle_data[f"{symbol}/CLOSE"]

sma_one = ta.sma(close_sr, 60)

sma_two = ta.sma(close_sr, 360)

average_sma = (sma_one + sma_two) / 2

new_indicators[f"{symbol}/PRICE/AVERAGE_SMA"] = average_sma

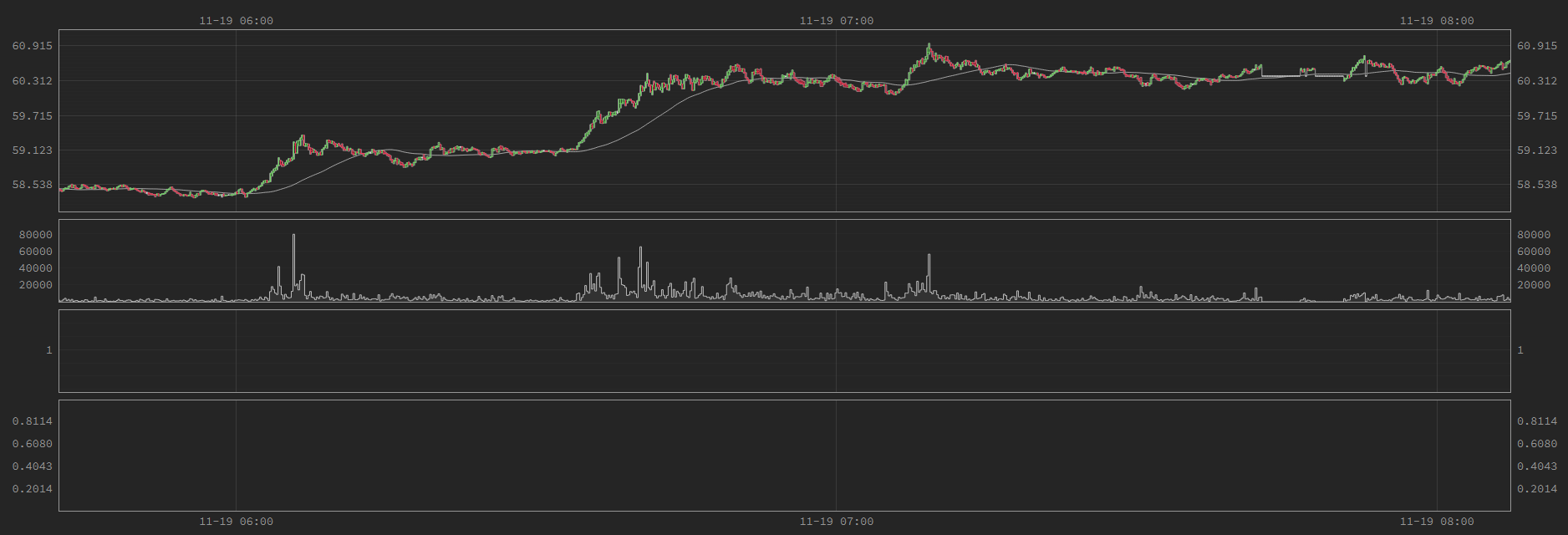

Below is the code that creates a market overheating indicator with two different moving averages and limits the value to not exceed 0.8. In the picture, you can see that everything above 0.8 is cut off.

import pandas_ta as ta

for symbol in target_symbols:

volume_sr = candle_data[f"{symbol}/VOLUME"]

sma_one = ta.sma(volume_sr, 360)

sma_two = ta.sma(volume_sr, 2160)

wildness = sma_one / sma_two # Division operation

wildness[wildness > 0.8] = 0.8 # Set the limit

new_indicators[f"{symbol}/ABSTRACT/WILDNESS"] = wildness

Below is the code that simply creates an indicator that delays the closing price by 10 minutes.

for symbol in target_symbols:

close_sr = candle_data[f"{symbol}/CLOSE"]

shifted_sr = close_sr.shift(60) # `Series.shift` method

new_indicators[f"{symbol}/ABSTRACT/SHIFTED"] = shifted_sr

As demonstrated, many variations are possible for indicators generation through coding.

As demonstrated, many variations are possible for indicators generation through coding.

Writing the Decision Script¶

The decision script is executed repeatedly every 10 seconds, which is the time length of a single candle. It is used to determine whether to place an order or, if so, which order to place.

API¶

Variables provided by default are as follows. You can use these without any import statements.

target_symbols(list[str]): The symbols being observed.current_moment(datetime): The current time rounded down to the base time. For example, if the current exact time is 14:03:22.335 on January 3, 2022, thencurrent_momentappears as 14:03:20 on January 3, 2022 in the 10-second interval.current_candle_data(dict[str, float]): Only the most recent row is truncated from the observation data recorded up to the current time. Contains price and volume information from the market.current_indicators(dict[str, float]): Only the most recent row up to the current time is provided. It contains different indicator information depending on the indicator script.account_state(AccountState): Contains current account status information. An object for reading. Writing something inside has no effect.scribbles(dict[Any, Any]): Free writing space where you can write anything. After making a strategic decision, you can put whatever you want to remember inside this object.decisions(dict[str, dict[OrderType, Decision]]): This is the core object that contains the strategic judgment.

Basic Syntax¶

You can extract a Series column from the candle DataFrame like this.

open_price = current_candle_data["BTCUSDT/OPEN"]

high_price = current_candle_data["BTCUSDT/HIGH"]

low_price = current_candle_data["BTCUSDT/LOW"]

close_price = current_candle_data["BTCUSDT/CLOSE"]

sum_volume = current_candle_data["BTCUSDT/VOLUME"]

AccountState object provided by the API has a structure like below.

class OrderType(Enum):

NOW_BUY = 0

NOW_SELL = 1

NOW_CLOSE = 2

CANCEL_ALL = 3

BOOK_BUY = 4

BOOK_SELL = 5

LATER_UP_BUY = 6

LATER_UP_SELL = 7

LATER_UP_CLOSE = 8

LATER_DOWN_BUY = 9

LATER_DOWN_SELL = 10

LATER_DOWN_CLOSE = 11

OTHER = 12

class OpenOrder:

order_type: OrderType

boundary: float

left_margin: float | None

class Position:

margin: float

direction: PositionDirection

entry_price: float

update_time: datetime

class AccountState:

observed_until: datetime

wallet_balance: float

positions: dict[str, Position]

open_orders: dict[str, dict[int, OpenOrder]]

scribbles are saved as pickle files. So it can hold almost any type of Python objects.

# When adding a data, simply assign it.

# The value can be of any type.

scribbles["WAS_SOMETHING_DONE"] = True

# When retrieving, it is recommended to use the

# `dict.get` method in case the value is not already stored.

did_i_do_it_before = scribbles.get("WAS_SOMETHING_DONE", False)

You can check the indicator’s current value with a string key expressed by three values divided by “/”.

# Create an indicator named SMA in the PRICE category.

sma_value = current_indicators["BTCUSDT/PRICE/SMA"]

Decision Types¶

There are 12 possible order commands, each corresponding to a specific order type on Binance. Simplified commands for easy and intuitive strategy development are used equally for automatic transaction and simulation.

Order type CANCEL_ALL cancels all open orders of the symbol market.

from solie import Decision, OrderType

decisions[symbol][OrderType.CANCEL_ALL] = Decision()

Order type NOW_CLOSE closes the position immediately. Corresponds to “Market Buy” or “Market Sell” orders on Binance with the maximum quantity and Reduce Only.

from solie import Decision, OrderType

decisions[symbol][OrderType.NOW_CLOSE] = Decision()

Order type NOW_BUY buys directly at market price. Corresponds to Binance order “Market Buy”.

from solie import Decision, OrderType

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.NOW_BUY] = Decision(

margin=wallet_balance * 0.08,

)

Order type NOW_SELL sells directly at market price. Corresponds to Binance order “Market Sell”.

from solie import Decision, OrderType

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.NOW_SELL] = Decision(

margin=wallet_balance * 0.08,

)

Order type LATER_UP_CLOSE puts an order that will close the position when the price goes up to that boundary. Corresponds to Binance order “Stop Market Buy” or “Take Profit Market Sell” with “Close Position” enabled.

from solie import Decision, OrderType

current_price = current_candle_data[f"{symbol}/CLOSE"]

decisions[symbol][OrderType.LATER_UP_CLOSE] = Decision(

boundary=current_price * 1.05,

)

Order type LATER_DOWN_CLOSE puts an order that will close the position when the price goes down to that boundary. Corresponds to Binance order “Stop Market Sell” or “Take Profit Market Buy” with “Close Position” enabled.

from solie import Decision, OrderType

current_price = current_candle_data[f"{symbol}/CLOSE"]

decisions[symbol][OrderType.LATER_DOWN_CLOSE] = Decision(

boundary=current_price * 0.95,

)

Order type LATER_UP_BUY puts an order to buy when the price goes up to that boundary. Corresponds to Binance order “Stop Market Buy”.

from solie import Decision, OrderType

current_price = current_candle_data[f"{symbol}/CLOSE"]

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.LATER_UP_BUY] = Decision(

boundary=current_price * 1.05,

margin=wallet_balance * 0.08,

)

Order type LATER_DOWN_BUY puts an order to buy when the price goes down to that boundary. Corresponds to Binance order “Take Profit Market Buy”.

from solie import Decision, OrderType

current_price = current_candle_data[f"{symbol}/CLOSE"]

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.LATER_DOWN_BUY] = Decision(

boundary=current_price * 0.95,

margin=wallet_balance * 0.08,

)

Order type LATER_UP_SELL puts an order to buy sell when the price goes up to that boundary. Corresponds to Binance order “Take Profit Market Sell”.

from solie import Decision, OrderType

current_price = current_candle_data[f"{symbol}/CLOSE"]

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.LATER_UP_SELL] = Decision(

boundary=current_price * 1.05,

margin=wallet_balance * 0.08,

)

Order type LATER_DOWN_SELL puts an order to sell when the price goes down to that boundary.Corresponds to Binance order “Stop Market Sell”.

from solie import Decision, OrderType

current_price = current_candle_data[f"{symbol}/CLOSE"]

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.LATER_DOWN_SELL] = Decision(

boundary=current_price * 0.95,

margin=wallet_balance * 0.08,

)

Order type BOOK_BUY puts a limit buy order that is added to the order book. Corresponds to Binance order “Limit Buy”.

from solie import Decision, OrderType

current_price = current_candle_data[f"{symbol}/CLOSE"]

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.BOOK_BUY] = Decision(

boundary=current_price * 0.95,

margin=wallet_balance * 0.08,

)

Order type BOOK_SELL puts a limit sell order that is added to the order book. Corresponds to Binance order “Limit Sell”.

current_price = current_candle_data[f"{symbol}/CLOSE"]

wallet_balance = account_state.wallet_balance

decisions[symbol][OrderType.BOOK_SELL] = Decision(

boundary=current_price * 1.05,

margin=wallet_balance * 0.08,

)

In automatic ordering and simulation, all prices are based on “last price”. “mark price” is not used in the calculation.

Side Note¶

Binance has a minimum order amount. As of February 2022, it is $5. In addition, the decimal precision of the quantity that can be ordered for each symbol is fixed. Therefore, in the actual automatic order, the order is sent with the quantity slightly rounded up from the margin included in the decision. Because of this rounding, the actual amount being orders can have a significant amount of numerical error. Always check your position status before making an order in the decision script.

Open orders are limited to only one per type. During an actual automatic order, even if multiple open orders of the same type are stacked, all but the most recent one will be lost. This is Solie’s own rules for a convenient decision system. For example, there cannot be more than one open order classified as LATER_UP_BUY at the same time. However, it is possible to have different kinds of commands open simultaneously. An open spell with LATER_UP_BUY and an open spell with LATER_UP_SELL can exist at the same time.

Even with the same margin, the actual amount value will vary depending on the leverage. For example, putting in a margin of $5 at 4x leverage means you are investing $20 in real money. Since leverage is the concept of borrowing and investing, the amount invested in my assets is less than the actual investment amount by the leverage multiplier.